China’s Low-Profile Davos Presence Still Shaped the Conversation

China did not dominate headlines at this year’s World Economic Forum, but it remained a central reference point in many of the debates in Davos. While leaders spent significant time on transatlantic frictions, security questions, and shifting alliances, China’s message was more consistent and more narrowly framed: keep markets open, keep rules predictable, and treat Chinese firms operating overseas fairly.

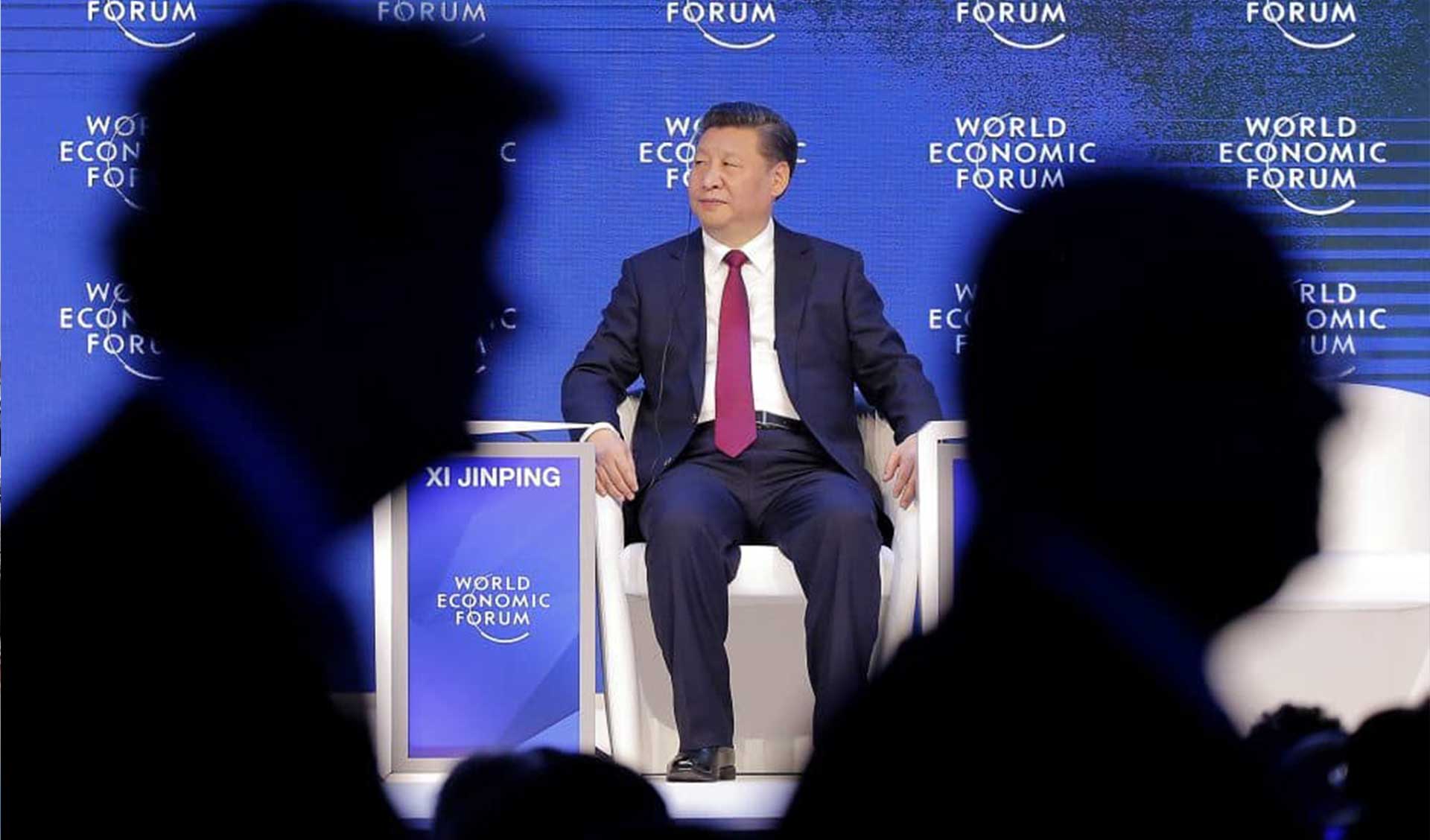

That stance was delivered by a senior Chinese economic official who used his Davos platform to emphasize cooperation and to signal that Beijing wants a steadier operating environment for Chinese companies expanding abroad. The remarks landed in a forum where attention was largely pulled toward U.S. rhetoric and the knock-on effects for allies, but the subtext was clear: China expects a more fragmented global economy, and it is positioning itself to benefit from that fragmentation where it can.

From export engine to capital exporter

The most consequential shift is that China is no longer relying solely on goods exports to extend its reach. It is increasingly exporting capital, capacity, and operational know-how, particularly into manufacturing, technology, and logistics networks outside the United States. Even as China posts very large trade surpluses, it has also been expanding overseas commitments through infrastructure, industrial projects, and commercial partnerships that deepen its influence across emerging markets and parts of the global south.

In practice, this is not a single strategy so much as a set of adaptations. Tariffs and tighter trade rules in advanced markets are encouraging more Chinese firms to localize production abroad, especially in politically sensitive sectors such as autos, batteries, and advanced manufacturing. This trend reframes China from “the exporter” to “the investor and builder,” with different political and regulatory implications for host countries.

The opportunity Beijing sees in widening Western friction

A recurring view among China-focused analysts is that rising tensions between Washington and some traditional partners create openings for Beijing, particularly in trade and investment diplomacy. When allies face uncertainty about U.S. policy direction, they often become more willing to diversify external relationships, even if those relationships remain carefully managed.

That dynamic has been visible in the uptick of high-level engagement with Beijing in early 2026. China hosted major bilateral meetings in early January with the leaders of Ireland and South Korea, both of which were publicly framed around cooperation and economic ties. Those visits were followed by a Canadian prime ministerial trip to Beijing in mid-January that both governments presented as a reset effort, accompanied by announcements focused on trade and industrial cooperation.

Separately, recent reporting has pointed to an imminent visit to China by the U.K. prime minister, underscoring the same diversification impulse as European politics becomes more complicated, and the U.S. approach to allies remains unpredictable.

Why China’s quiet messaging can be more influential than headline moments

Davos often rewards rhetorical drama, but influence can come from repetition and clarity rather than spectacle. China’s approach tends to avoid theatrical announcements in favor of reinforcing a few stable themes: economic openness, opposition to discrimination against Chinese firms, and skepticism toward unilateral restrictions. Over time, that predictability can matter to multinationals and to governments in emerging markets seeking capital and industrial development without being fully drawn into great-power bloc discipline.

At the same time, Beijing’s external push runs into real constraints. Domestic demand remains a weak spot, and policymakers continue to talk about boosting household income growth and consumption, even as implementation remains uneven. The gap between China’s external strength and its internal rebalancing challenge is one reason the “China factor” persists in Davos discussions: global supply capacity and investment flows remain strong, while China’s domestic absorption is less reliable.

A world where the forum itself may “decentralize”

One additional theme emerging around Davos is that global convening power is diffusing. The forum’s own ecosystem increasingly includes events outside the Alps, including its long-running “Summer Davos” meeting in China, which alternates between Chinese host cities. This reflects a broader reality: as economic gravity shifts toward Asia and other fast-growing regions, global business dialogue is likely to become more geographically distributed.

What to watch next

The key question is not whether China will be discussed at global summits, but how other countries operationalize their response:

- Will partners accept higher trade exposure to China as a cost of hedging geopolitical risk elsewhere?

- Will Chinese outward investment accelerate in manufacturing and technology as firms adapt to tariffs and tighter trade rules?

- Will regulatory scrutiny intensify around data, technology transfer, and supply-chain security as China’s overseas footprint deepens?

China may not have captured the loudest moments in Davos, but the direction of travel is hard to miss. In a world moving toward regional blocs and selective decoupling, Beijing is working to convert its production scale into durable overseas operating positions, and many countries are quietly testing what that relationship can offer.